Sole Proprietorship vs S-Corp Tax Spreadsheet for Internet Publisher and Youtuber - Which Will Save More Tax Money? - TechWalls

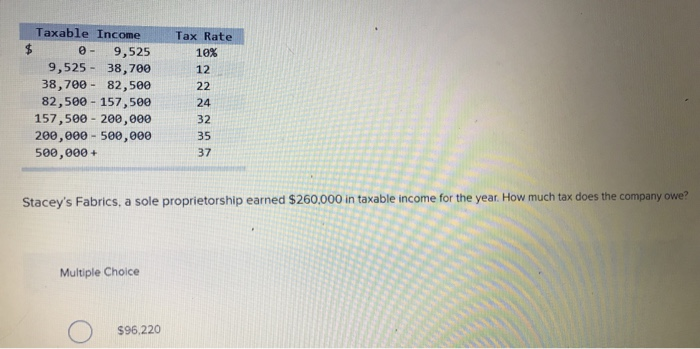

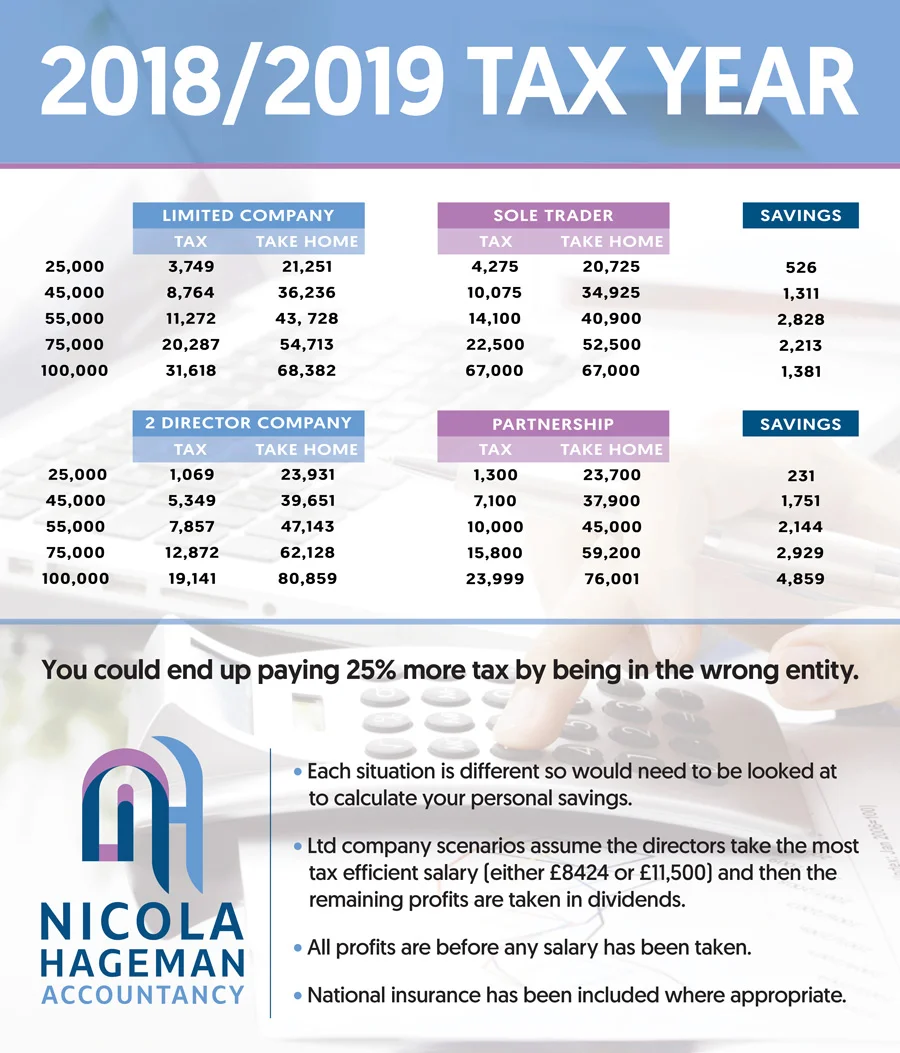

Paterson Tax Services - Taxes as a sole trader👩🏻💻 Sole traders pay income tax as well as Class 2 and Class 4 national insurance. 💰Class 2 national insurance - £3.05 per week

:max_bytes(150000):strip_icc()/soleproprietorship-Final-578020d8a89e486180a235fe9e76c9e9.jpg)

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)